Equipment Financing Made Simple — No Hoops, No Headaches

Getting equipment financing shouldn’t feel like running an obstacle course. At Equipment Finance Services (EFS), we’ve seen every roadblock — mountains of paperwork, long waits, credit worries — and EFS has cleared them all. Our team’s built a faster, friendlier way to get the machines you need without the headaches. Real people. Straight answers.

Legendary Approvals, No Waiting Around

How Fast Can You Get Approved?

Faster than your next coffee break. Most customers hear back the same day, often within hours. Once approved, you’ll sign electronically, and we’ll sync funding with your pickup. No back-and-forth, no downtime. Just fast equipment financing that moves as quick as your business does.

What Factors Affect Approval?

We look at the whole picture, not just a credit score. Things like your business history, the kind of gear you’re buying, and your project goals all matter. We work with all kinds of operators, from first-time buyers to seasoned fleets, and tailor terms that make sense for you. Want a few equipment financing approval tips? Talk to a financing specialist who actually speaks your language.

Simplified Docs. Fast Deals. Done.

Say Goodbye to Endless Paperwork

Our low doc equipment loans keep things simple. Typically, we just need your completed application and basic business info. That’s it. We cut through the red tape so you can get your gear and get back to the job site.

What Do You Need to Apply?

You’ll just need:

Business name, EIN, and owner contact info.

Equipment details or dealer quote.

Owner ID for verification.

That’s it — really. No binders, busywork, or backlogs. Just a clean, straightforward equipment loan application designed for busy business owners.

Flexible Credit Options For Every Business

Soft Credit Pulls, Not Hard Hits

We’ll never ding your credit just for checking your options. EFS runs a soft credit pull, so there’s zero impact on your personal score. That’s part of our promise: honest, transparent, and accessible financing.

Corporate-Only Financing for Established Businesses

If your business is well-established, you may qualify to apply under your company name — no personal guarantees required. It’s our way of rewarding strong business credit and years of hard work. You’ve earned it.

Your Questions, Answered

What if my business is new or growing?

No problem. We work with younger companies that have proven revenue or a solid plan for growth. We’ve helped small trades, landscapers, builders, and contractors move from one forklift or skid steer to a full lineup of machines, all with clear, simple terms that grow with them.

What if I need used equipment or something specific?

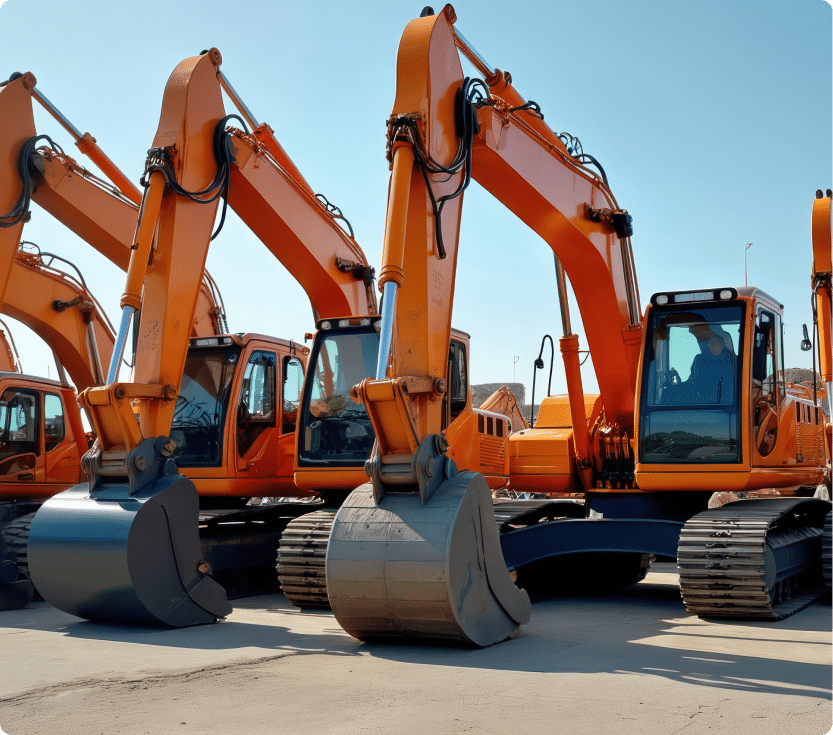

We finance both new and used gear. Any brand, any dealer, anywhere in the country. If it lifts, digs, or hauls, we’ll find a way to make it happen. That’s flexibility you won’t find at a bank.

What if I need my equipment right away?

That’s our specialty. We coordinate directly with your dealer to match approval, funding, and delivery. Many customers are picking up their machine the same day they’re approved. Same-day equipment financing? That’s EFS in action.

What Makes EFS Stand Out

Made for the People Who Get Things Done

We’re not bankers in suits. We’re financing pros who understand what it takes to keep your business moving. You’ll get soft pulls, low-doc approvals, and fixed payments that never surprise you. No fine print. No runaround. Just legendary financing that works as hard as you do.

Let’s Clear the Path to Your Next Piece of Equipment

Whatever’s holding you back — paperwork, credit worries, time — we’ve got a fix for it. Apply online, get approved fast, and we’ll walk you through the rest.