Dealer Equipment Financing That Helps You Close More Sales

Running an independent dealership isn’t easy, especially when big networks offer in-house financing you can’t match. But with Equipment Finance Services (EFS), you don’t have to build your own financing program to stay competitive. We deliver legendary dealer equipment financing that’s fast, flexible, and built to help you move more machines, faster. You sell, we handle the financing — no extra staff, no extra systems, no delays.

Why Dealers Partner With EFS

Financing That Closes Deals, Not Doors

EFS gives you a complete point of sale equipment financing solution without the overhead. We help remove common buyer objections, so you can close more deals and keep your inventory moving.

- Boost deal conversions with same-day approvals.

- Help buyers say “yes” faster with predictable terms.

- Offer financing without taking on extra admin or risk.

When customers know they can finance their equipment on the spot, they’re far more likely to buy — and buy from you.

Compete With the Big Guys. Stay Lean.

Whether you’re selling five or 50 machines a month, EFS gives you scalable tools and white-glove support.

White-labeled financing application.

Streamlined workflows.

Fast document turnaround.

Built-in flexibility.

We bring enterprise-level equipment dealer financing programs to independent lots and regional sellers, so you can offer the same experience without the internal infrastructure.

Turnkey Financing. Zero Headaches.

A Simple Way to Offer Legendary Financing

Here’s how it works:

- Your customer chooses their equipment.

- You send us the deal details.

- We handle the credit check, approval, and documentation.

You stay focused on closing the sale. We take care of the financing.

Fast Approvals = Faster Inventory Turnover

Every day a machine sits on your lot is a day it’s not making money. EFS delivers same-day approvals and digital paperwork, speeding up sales and improving cash flow.

Finance Any Brand.

Any Build. Any Day.

EFS finances both new and used equipment from any manufacturer. Need to include attachments, warranties, or service plans? We can bundle those into the deal, too. That’s vendor financing solutions made simple.

A Partnership That Builds Loyalty

Customer Loyalty That Sticks

Financing isn’t just about getting a deal done — it’s about creating long-term loyalty. When you offer seamless financing, you become a trusted advisor.

- Encourage repeat purchases.

- Build long-term relationships.

- Offer real value without added complexity.

Your Sales Team Just Got Bigger

Think of EFS as your behind-the-scenes closer. We’ll support your team with co-branded marketing materials, white-labeled financing applications online, on-demand training, and responsive communication, all designed to help you close the next deal faster than a Sasquatch sighting.

Built for Independent Dealers

Small Teams. Big Moves.

- Tight margins. Small teams. Fast-moving deals. We’ve built our process with real-world dealer needs in mind.

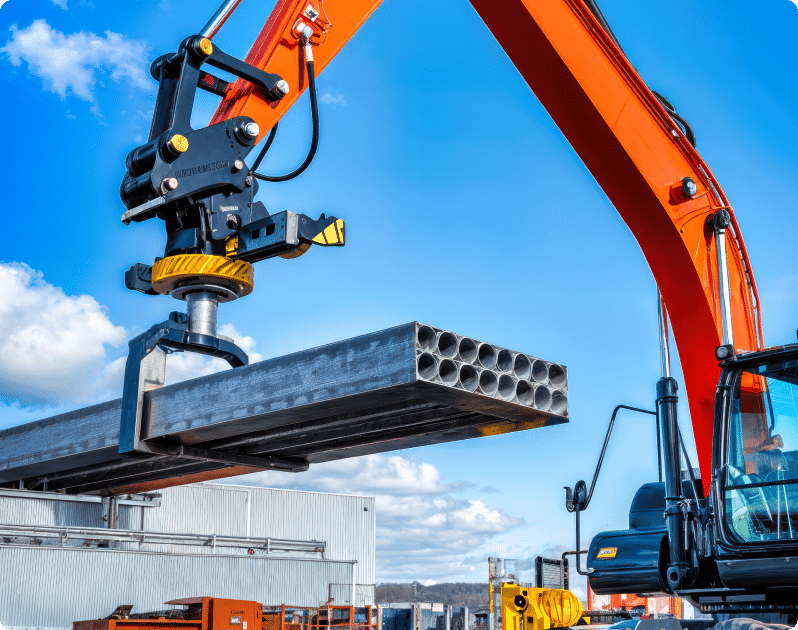

- EFS partners with dealers selling construction, landscaping, and material handling equipment, especially those with average unit prices between $10K–$175K.

Flexible Programs That Grow With You

Whether you want to finance one deal a month or build a full-scale program, we offer flexible structures to match.

- One-off transactions or long-term vendor partnerships.

- Custom financing options for your customers.

- Ongoing reporting and performance optimization.

We grow with you, and help you grow faster.

Ready to Accelerate Sales?

Let’s build a legendary financing partnership that drives results.

Faster deal closings. Fewer buyer objections. More repeat customers. With EFS, you can offer top-tier financing without taking on top-tier overhead.